In Italy, all major credit and insurance institutions have a home banking or home insurance application, through which users can manage accounts and policies. This is a rather fragmented context, which still requires a dedicated and separate application for each institution, thus adding complexity-especially in insurance-to the already articulated management of policies and coverages from multiple channels.

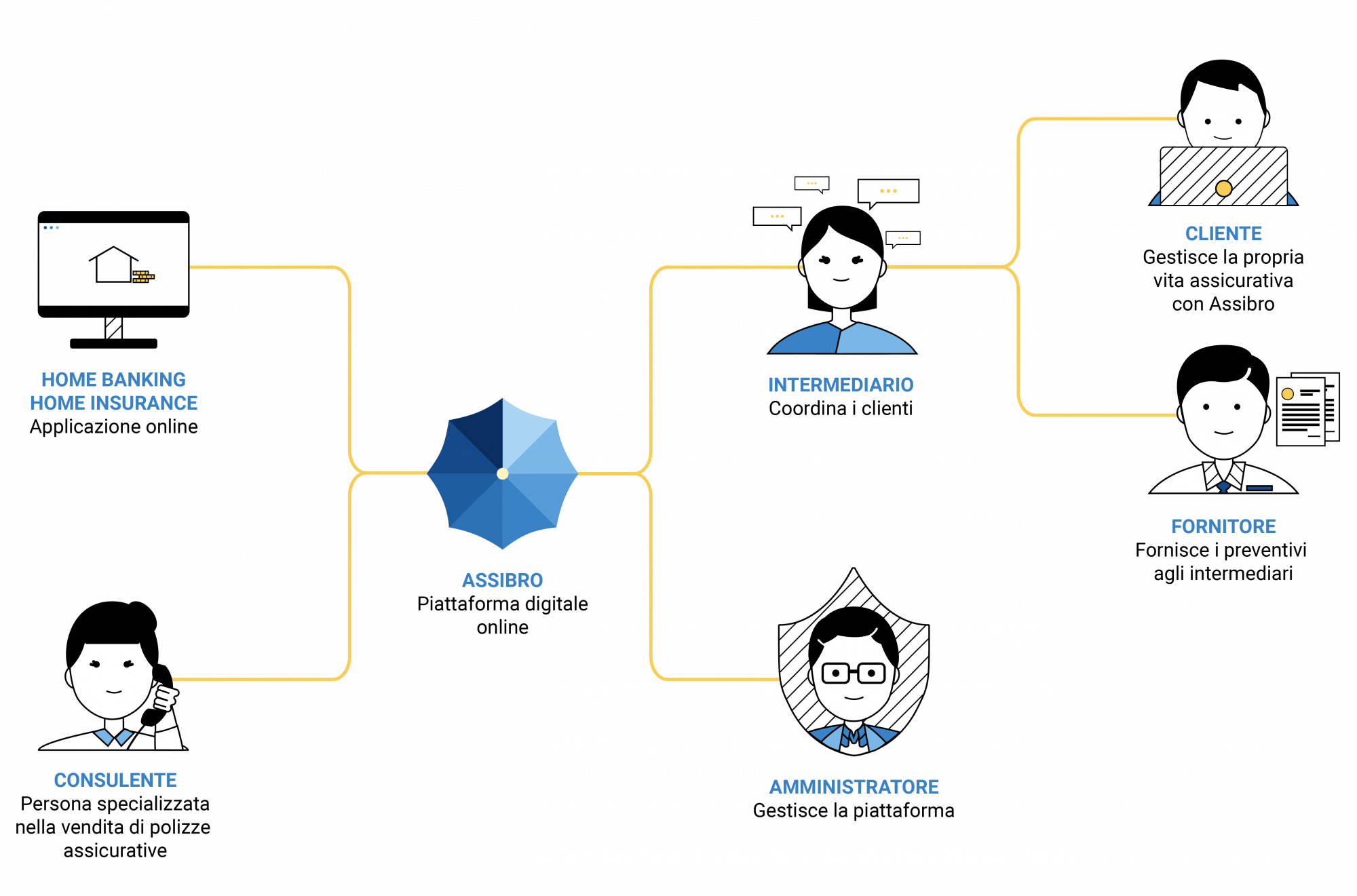

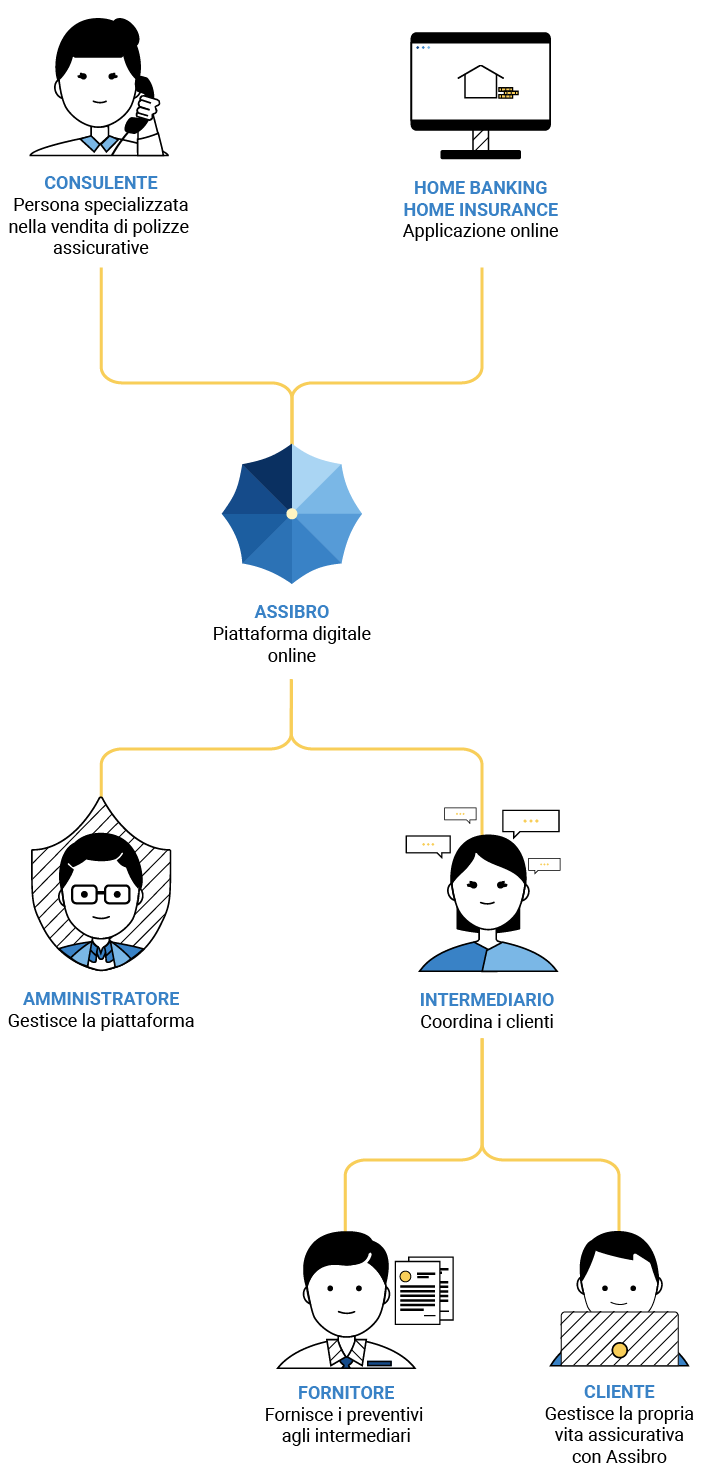

In 2019, Enrico Perlin, a freelancer in the insurance industry for several years, has the intuition: to create a single digital "place," capable of offering clients the ability to manage their insurance life and intermediaries to coordinate all clients, guaranteeing them the best policies.

An idea that intercepts real needs, but how to turn it into a tangible business project? Enrico has industry expertise, knowledge, and adequate channels to engage insurance companies, brokers, and customers, but he lacks experience, know-how, and a team of experienced people to develop and launch the project.

We thus begin a consulting journey alongside him, with the aim of accompanying him in the creation and startup of this new startup. We form a multidisciplinary team dedicated to the project, dealing strategically and operationally with the following activities:

- software analysis and development;

- concept and design of web platform and mobile application;

- coordination, management and integration of external systems: insurance management and electronic payment with digital signature.

We devote an initial phase to analyzing the competitive scenario, critical issues and opportunities for the market, and medium to long-term goals, and once we have identified and clarified how to digitize the insurance brokerage flow, we define business plan and operational strategy.

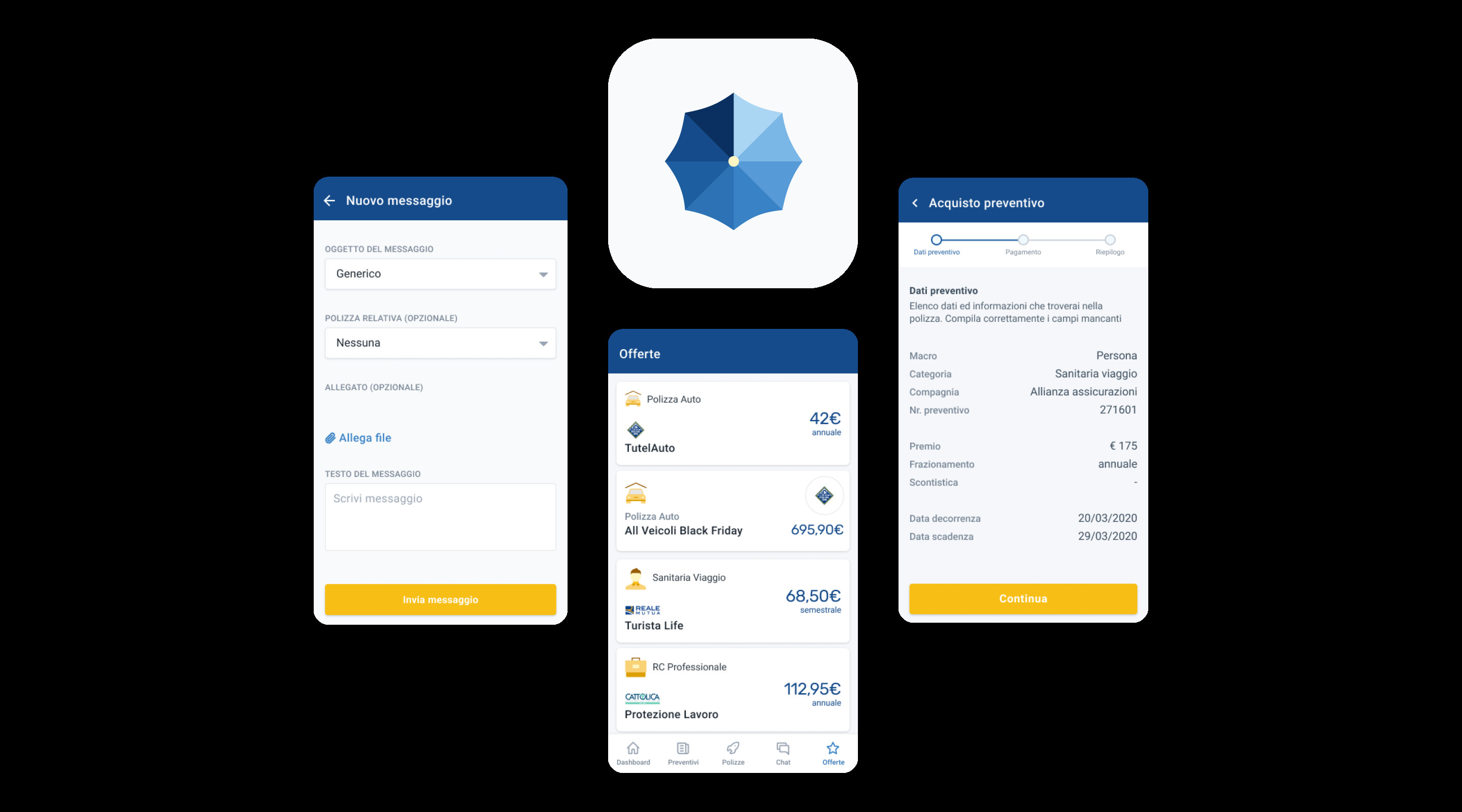

We work with bi-weekly development and review cycles, so that Enrico is aligned in real time and any revisions can be made in the process. In a few months we develop a multichannel (web and mobile) platform: mobile for customer and broker-specific features, web for all features dedicated to providers and Assibro employees.

The native application we create allows users to consult, purchase and manage policies from any insurance company; at the same time, suppliers and Assibro employees have the opportunity to manage documentations and requests, quotes and policies, up to finalizing each operation by finalizing payments.

We complete the technological development of the platform with the integration of an external digital signature service for all the documentation issued by the platform and the interaction with a third-party management system capable of carrying out an exchange of data related to customer policies and invoice issuance.

Contextually, we work on the digital identity of the project, identifying the most incisive concept and interface design, weighing all the graphic components of the application that would determine its usability. The result is a very simple and "user friendly" design that facilitates each user's navigation and user experience.

In 2020, Assibro, the first insurance broker company to offer its customers aggregated management of insurance policies from any company was launched, followed by the release of the app in the Apple and Android stores.

Our collaboration is still ongoing; we continue to follow every activity of maintaining the platform and developing strategic features to the needs of the market.